As December unfolds across Africa, the festive rush is on — but this year, the holiday shopping season carries a very different flavour. From Kampala to Cape Town, from informal markets to slick malls and online shops, shoppers are rethinking how they celebrate. Rising costs, tightening household budgets and shifting consumer values are reshaping what Christmas shopping means — and how it’s done.

A Holiday Season under Pressure — But Not Cancelled

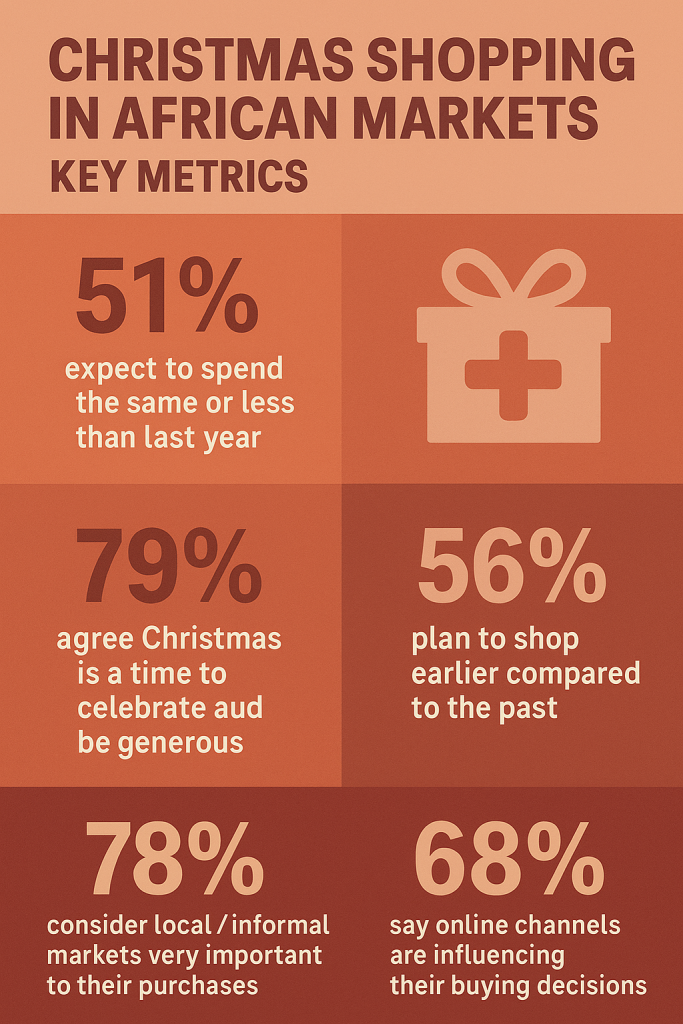

Economic realities are weighing heavily on shoppers across several African markets. Many consumers report that they’re likely to spend the same or less this holiday season compared with previous years. In South Africa — often seen as a bellwether for the region — about 73% of shoppers expect to maintain or reduce their Christmas spending in 2025.

Similarly, analysts observe that the holiday shopping season itself appears to be shorter than usual, with consumers tightening their gift budgets and paring down extravagant spending.

However, the mood is not uniformly pessimistic. Where incomes allow — and where value and meaning are available — many are still embracing holiday traditions. For them, Christmas remains a time for celebration, family, and modest generosity.

Shopping Smarter: Value, Meaning — Not Excess

Recent global retail research suggests that 2025’s holiday shoppers — in Africa as elsewhere — are becoming more intentional: prioritising value, practicality, and meaning over impulse or luxury.

In markets such as South Africa, this has translated into mixed shopping habits:

- A significant share of shoppers combine online and in-store shopping, enjoying the convenience of digital browsing while preserving the in-person experience.

- Many begin their festive purchases early — even before November — to manage budgets and avoid last-minute price surges or stockouts.

- For those operating on sensible budgets, gift cards, vouchers, and affordable local offerings remain popular — rather than high-end or imported gifts.

In other words: Christmas in 2025 is increasingly about meaningful gifting — small gestures, practical presents, shared meals — rather than lavish displays.

The Role of Local Markets, Informal Retail, and African Realities

While global data offers a backdrop, Christmas shopping across Africa also plays out against unique local dynamics. For many households, festive purchases go beyond gifts: food, groceries, household staples, and communal celebrations take priority. This often means turning to traditional markets, informal traders, and tight-value supply chains rather than upscale malls or luxury items.

A 2024 report on Uganda’s festive sales, for example, flagged that holiday discounts and “sales season” buzz often fail to deliver meaningful price relief; many shoppers said prices were actually higher in December than at other times. Monitor

This underlines a persistent challenge: formal retail “holiday hype” doesn’t always align with on-the-ground realities for many African families. For retailers and brands looking to succeed, understanding that gap — and offering affordable, relevant, culturally resonant options — is key.

A Growing Digital + Omni-channel Shift

Though informal markets and traditional shopping remain central in many African economies, digital retail and hybrid shopping approaches are increasingly visible — especially in urban and more connected areas.

Global holiday-shopping trends show a growing reliance on online discovery, social media influence, and digital toolsto guide purchases, even if the final sale happens offline.

In South Africa, retail experts advise that peak-season marketing (including campaigns around Black Friday and Christmas) be planned as holistic, multi-channel strategies, blending online presence, promotions, and physical retail — to meet shoppers where they are.

For African retailers and brands, that suggests opportunities — but only if they adapt to changing shopper expectations: affordability, flexibility, and respect for local shopping habits.

What This Means for African Retailers & Shoppers

- For retailers: Success may not come from big-ticket or imported luxuries. Instead, offering affordable, functional items, flexible payment methods, and a mix of digital + physical presence could resonate more with cost-conscious shoppers.

- For consumers: Christmas 2025 is less about “keeping up appearances” and more about celebration, togetherness, and practicality. Gift-giving — if it happens — is more deliberate, modest, and meaningful.

- For policymakers / public interest: Given that many families tighten spending during holidays, there’s a chance that festive seasons become moments of financial strain — especially where informal incomes dominate. Awareness and community support systems remain vital.

As December lights go up across African cities, the spirit of Christmas remains — but for many, it looks different this year. Less about glitz, more about resilience; less about excess, more about community, memory, and modest joy. For shoppers and retailers alike, success this season means adapting to that reality — with authenticity, empathy, and savvy planning.

+ There are no comments

Add yours